As only six to eight per cent share of all sales happening via quick commerce are incremental, the rapid delivery model is eating into the market of traditional retail. A report by Kearney has revealed that the majority of sales on quick commerce platforms come at the expenses of other channels, especially modern trade and ecommerce, followed by general trade outlets.

A comparison of market prices revealed that modern trade and ecommerce platforms consistently offer the biggest discounts to shoppers, in the range of 13 to 18 per cent. The report noted that price discounting in quick commerce is seen at six to nine per cent, compared with general trade, which ranges from two to five per cent.

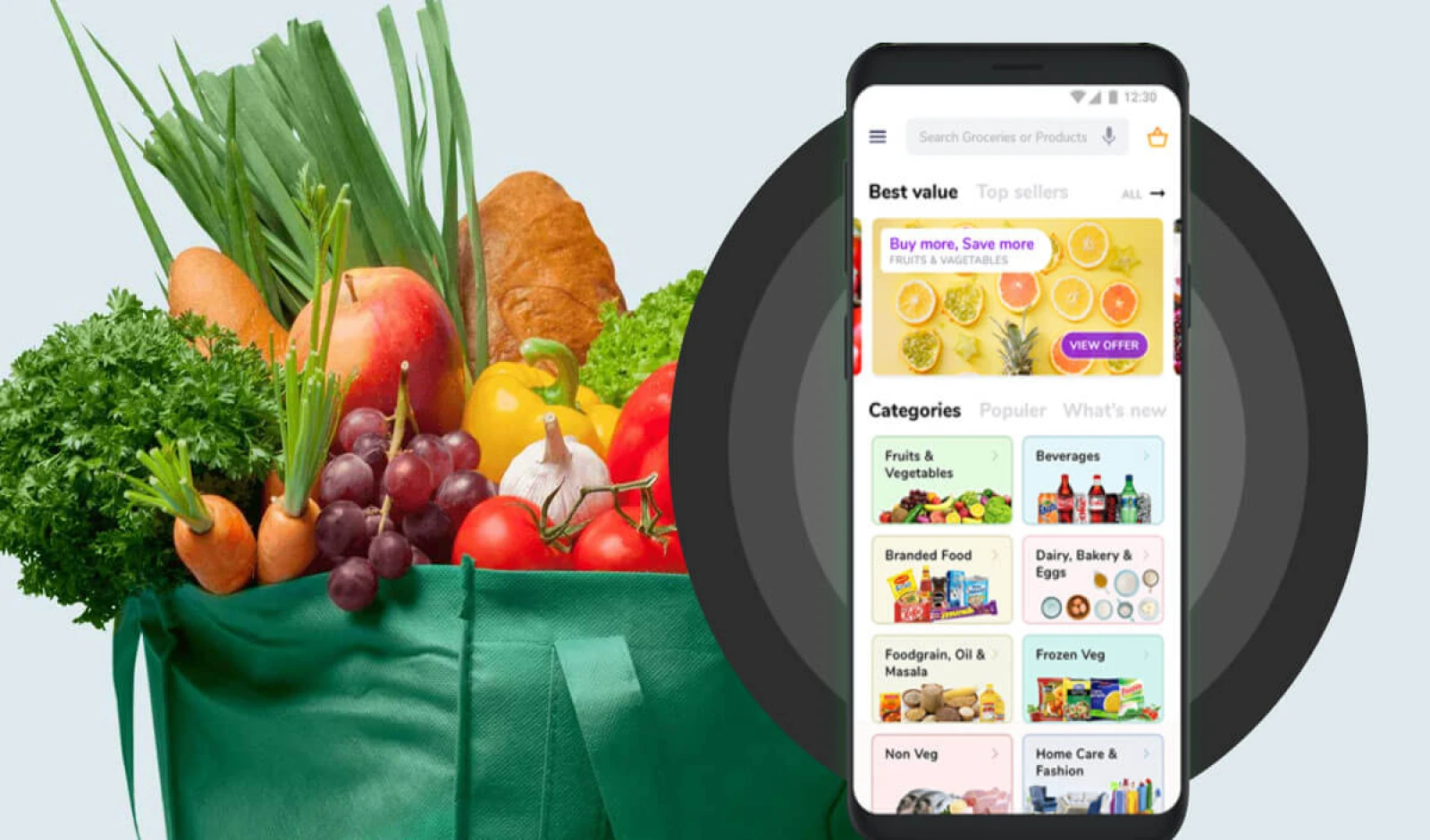

Before the arrival of quick commerce, only 33 per cent of frequent users favoured online platforms for their daily shopping. However, with its rise, this has surged to 87 per cent, indicating a major consumer shift toward digital-first shopping. The report attributed this to convenience and instant gratification that the rapid delivery model offers.

While the shift of consumers to quick commerce is clearly visible, there are still inconsistencies across categories, the report noted that in the initial growth phase, food categories saw the highest migration, with staples leading the adoption. However, the shift in fresh produce (fruits and vegetables) is lower, signalling that consumers still love to handpick non-packaged items.

Quick commerce is also emerging as the driver of premiumisation in certain categories. The report noted that segments such as gifting, personal care and household needs have witnessed the highest shift toward premium products.