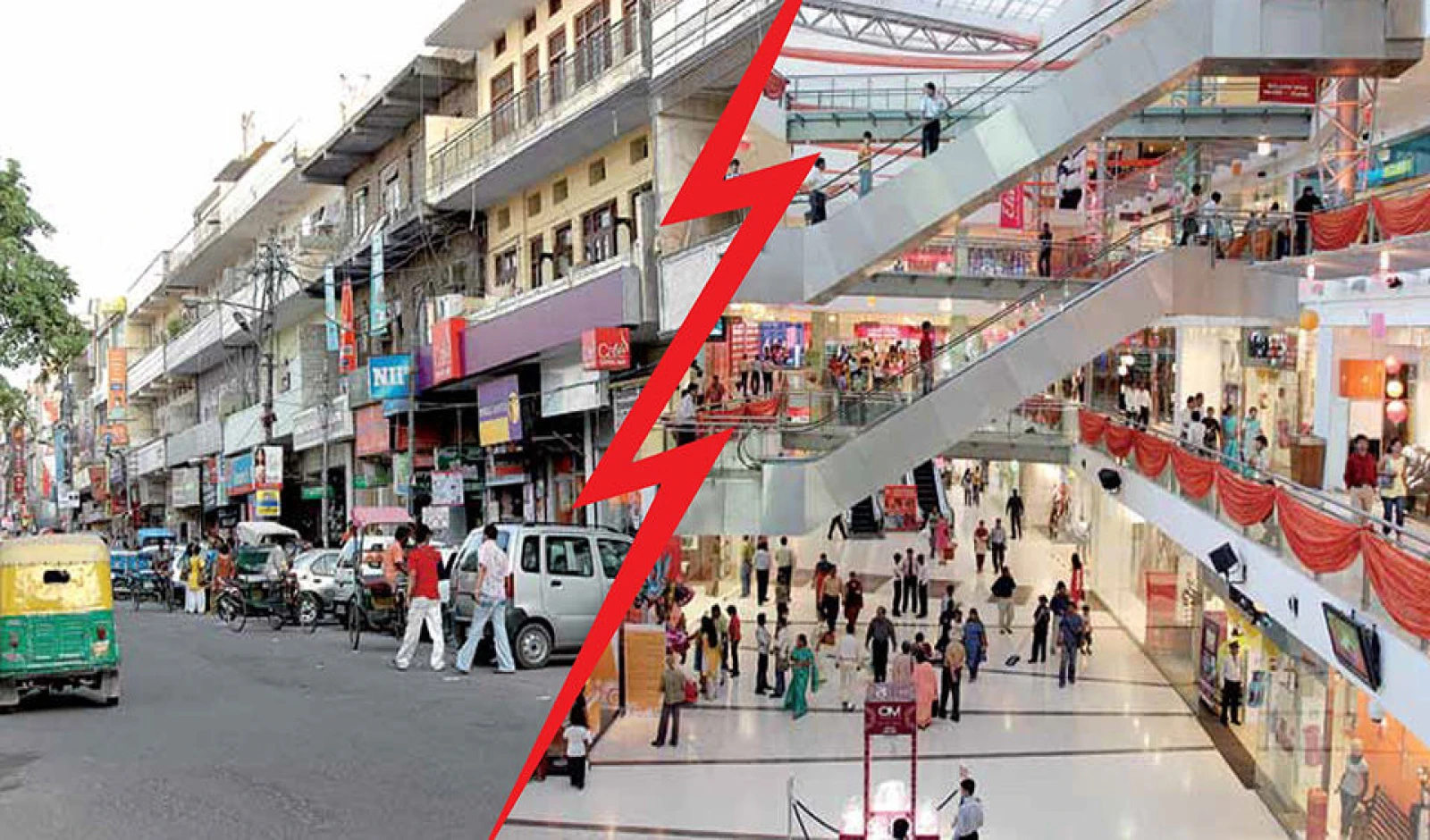

In a lively panel discussion at the Bharat Startup Summit 2025 in New Delhi, moderated by retail expert and ActionCOACH business mentor Niranjan Singh (ActionCOACH North East), the spotlight was firmly on the debate: Malls vs High Streets-Where is Retail Headed? The session brought together leading voices from the fashion and lifestyle retail sectors to dissect what’s working, what’s shifting, and what brands must weigh when choosing the right real estate model for growth in today’s dynamic retail landscape.

“Location is No Longer Just Footfall, It’s About Fit”

Akash Kalra, Managing Director, United Group the third-generation entrepreneur behind legacy brand United Group, emphasized the evolving nature of retail spaces. “Earlier, it was about getting maximum footfall. But today, brand identity, experience, and contextual relevance are equally critical. Whether it's a mall or high street, the location must fit your product’s story,” Kalra shared.

He added that United Group has seen success in both formats but views high streets as better suited for impulse and convenience purchases, while malls work well for experiential categories like lifestyle, fashion, and family-oriented shopping.

“We Choose Malls for Discovery, High Streets for Repeatability”

Sshruti Khaneja, VP-Offline Sales, Clovia brought in the D2C brand perspective. “As a digitally native brand entering offline, our choice of location depends on the customer journey. Malls help us with brand discovery and build, while high streets offer accessibility for repeat purchases.”

She stressed that Clovia’s decision matrix includes demographic fit, rental economics, and brand synergy with neighboring stores. According to her, modern malls offer better infrastructure for promotions and curated customer engagement, especially for lingerie and personal care categories.

“High Streets Build Connect, Malls Build Perception”

Manish Sharma, Co-Founder of the contemporary ethnic wear brand Karigari, and also the Director at FTOIC Group, brought in the franchising perspective. “Franchisees often prefer high streets for operational ease and lower rentals. But from a brand perspective, malls elevate perception, especially in Tier I and emerging Tier II cities.”

Sharma added that for Karigari, a hybrid strategy works best. “It’s not about either-or. It’s about which geography needs what kind of positioning. We've opened in malls like Select CITYWALK and also expanded through franchisees in key high-street markets.”

“Experience Trumps Location in D2C Retail”

Amar Preet Singh, Co-Founder, Neeman's , took a consumer-first approach. “In our segment, customer education is crucial. So, we prioritize experience. Malls give us that space and ambience. But with rising rentals, we’re evaluating selective high street presence as well.”

Singh added that experiential touchpoints, digital integration, and sustainability storytelling need physical spaces that offer time and attention from the shopper—something malls still do better.

“The Future is Omni-Location Strategy”

Wrapping up the session, moderator Niranjan Singh noted, “Retail is no longer about choosing between malls or high streets. The future lies in designing an omni-location strategy that caters to the life stages of both the brand and the customer.”

Drawing on his background in mall consultancy in the Middle East and India, Singh emphasized the importance of data-driven location planning, flexibility in formats, and brand alignment with real estate trends.

What matters most

- Brand stage matters: Emerging D2C brands prefer malls for visibility; established players leverage high streets for repeat business.

- Category relevance drives location: Lingerie, lifestyle, and footwear categories lean towards experiential formats like malls.

- Franchise economics differ: Franchise partners often favor high streets due to capital efficiency and lower operational costs.

- Experience is the new retail currency: Whether high street or mall, the ability to deliver experience will drive consumer loyalty.

As we are in third quarter of 2025, the Indian retail playbook is shifting from a binary model to a more nuanced, dynamic real estate mix, where brand vision, consumer behavior, and operational agility will decide the winners.